Several Founders, Co-Founders, CXO Bankers, CXO Fintech professional & people who participated in the ePanel discussions:

- Mr. Rakesh Watal, Head Liability Operations Western Region, HDFC Bank

- Mr. Sheoji Meena, General Manager, Bank of India

- Mr. P B Prakash, Head-Financial Institutions Group, IndusInd Bank

- Mr. Jayesh Shah, CEO, Prism Cybersoft Private Ltd

- Mr. Ramasubramanian S, Deputy Vice President, Axis Bank

- Mr. Arun Tanksali, Co-founder & CTO, Nearex

- Mr. Manoj Sharma, CEO, Exuberant Systems Pvt Ltd

- Mr. Ruchir Inamdar, Strategist, Jumper.ai

- Mr. Rajiv Rai, former Chief Digital Officer, Edelweiss Financial Services

- Mr. Neeraj Chandra, Head of Operations and Technology, India, Abu Dhabi Commercial Bank

- Mr. Chris Wakare, Founder & CEO, IntelliConnect Technologies

- Mr. Hemal Shah, former Technical Product Manager, Mastercard

- Mr. Rakesh Shetty, Product Head Micro Loans, Fortune Credit Capital Ltd

- Mr. Himanshu Khare, former Head Corporate Legal & Advisory, VISPL

- Mr. Arushi Govil, former Senior Manager – Legal, PayU Payments Pvt. Ltd

- Mr. Vikas R Panditrao, Co-Founder, Forum of Industry and Academic Knowledge Sharing (FIAKS)

- Many other CEO/CXO Bankers & Fintech professionals on FIAKS Forum requested to remain anonymous

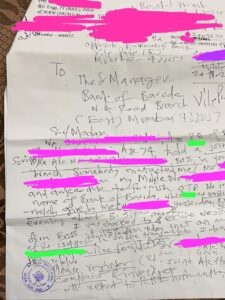

Here’s a case study shared by a community; “80 years old receives a call from a fraudster saying that I am from Bank of Baroda which is getting merged with other PSU banks. To keep the ATM active please give the OTP. Else you will have to come to the BOB branch office to activate ATM Card. 80 years old man is helpless and knows the pains of visiting the office in COVID times hence agrees to give OTP and Rs. 18000 gets debited from the account. The worst part is branch head and Police officer advises 80 years old man that nothing can happen as you gave OTP. I am accepting your complaint as a formality. Please forget this money.”

A member highlighted another new cybercrime- fraudsters are calling and asking for COVID-19 vaccine registration. They ask for Aadhaar, email id, etc. Subsequently, to authenticate Aadhaar, they ask for OTP. The moment OTP is given, money is siphoned off from the Aadhaar linked bank account.

So now how do we de-risk senior citizens here;

- In the above-mentioned case, the money got transferred digitally. If banks or the service provider (NPCI in case of UPI), can’t find the money trail, then NPCI has to pay. If the recipient money can’t find the actual person to whom the account belongs means that KYC is not proper. The bank should be asked to pay the money + penalize the bank for not doing the KYC properly. Get the Aadhaar details and blacklist the Aadhaar card. Wherever the Aadhaar card is being used catch hold of the person. Collect the money from that person and credit back the funds to the recipient bank. Until this is done, no bank will be serious in finding out the details of the person who has done the fraud as banks are not losing money, and they can put the blame on the senior citizen.

- Well RBI had issued a notification regarding Door Step Banking that stated – “In view of the difficulties faced by senior citizens of more than 70 years of age and differently-abled or infirm persons (having medically certified chronic illness or disability) including those who are visually impaired, banks are advised to make concerted effort to provide basic banking facilities, such as pick up of cash and instruments against receipt, delivery of cash against withdrawal from an account, delivery of demand drafts, submission of Know Your Customer (KYC) documents and Life certificate at the premises/ residence of such customers.” [1]

As seen above policeman is a reflection of the world’s insensitiveness towards such losses;

- A member states, “I really wonder if the police are even equipped to investigate such frauds. From what I read in newspapers the investigation closure or success rate of online or digital frauds (which require cyber tech forensics) is dismal. Forensics is absolutely lacking and we have seen in recent cases that basic evidence collection and retention skills are lacking. My friends’ father also got cheated in a call from Chattisgarh, same police said we will take complaint but nothing can be done.”

- It is surprising to know that only 11,000 crs per year is the cost of police (salaries, benefits, pensions) in Maharashtra alone.

- More than safety its critical and alternative mechanism outside of police fraternity needs to be commissioned for eg detective services and their evidence collection, dependence on police should be slowly made redundant at least in tech and cyber-crimes. That makes buck stop on no one’s table!

What can be the way forward? Some recommendations put forth by the members;

Register and Read the Complete bespoke discussions