- Mobile application – In six months, customers in the U.S will be able to sign up for the Apple Card in the Wallet app on their iPhone within minutes and be able to start using it with Apple Pay straight away. While many banks, old and new, now allow customer to sign up for a credit card online, the ability to use credit immediately is an emerging concept.

- Spending breakdown – Although there has been extended discussion around whether color-coding types of transactions actually helps customers save money, Apple is also offering categorization of payments and dividing them into classes such as Food and Drinks, Shopping and Entertainment.

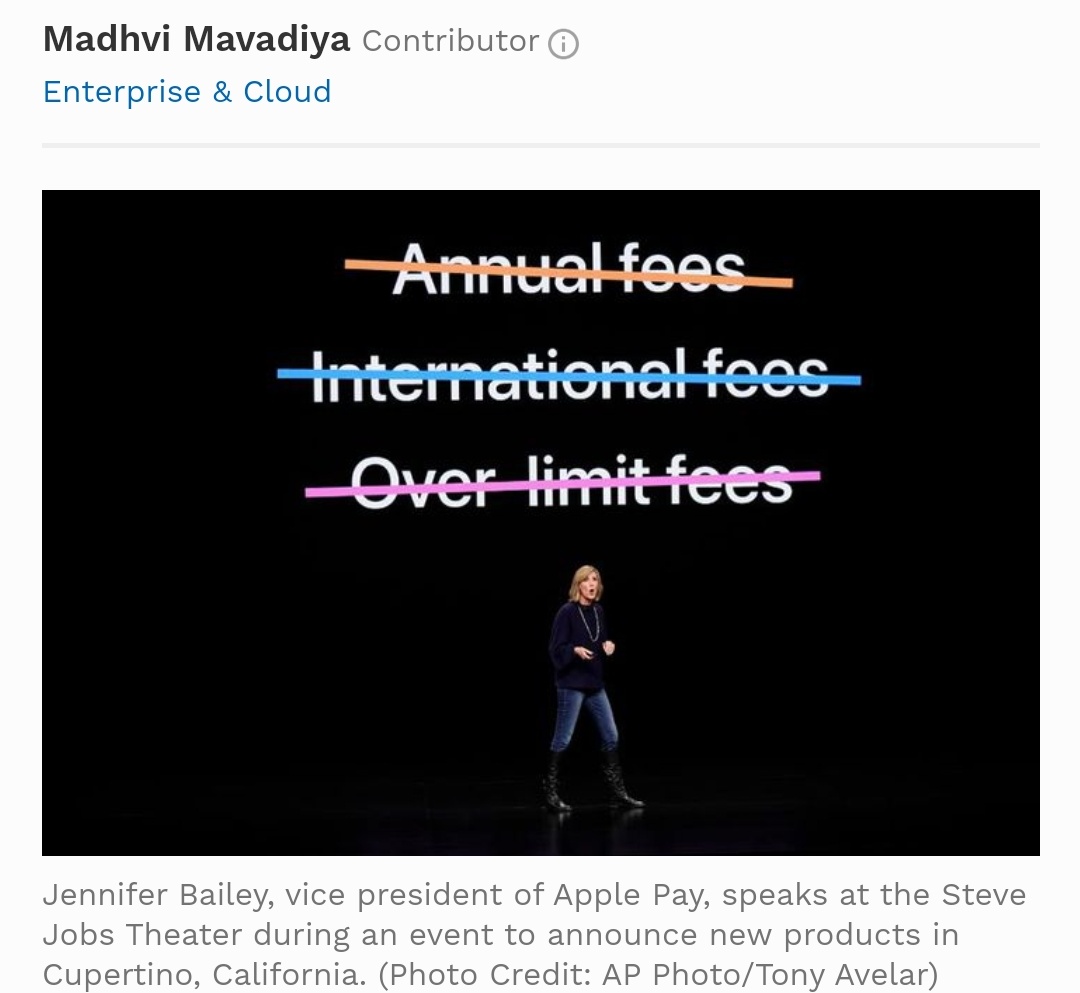

- Cashback, fees and interest – Cashback is another feature that legacy banks, challenger banks and fintech firms are introducing within their products and services to leverage this millennial trend of loyalty and rewards; Lloyds have an offers scheme for account holders and Tandem have introduced a Cashback credit card, but both repay users at the end of the month.

- Biometrics – As mentioned above, Apple have already normalized paying with your mobile phone and in turn, normalized biometric security authentication. In addition to Face ID and Touch ID, a unique card number is created on the iPhone and stored in the Apple security chip Secure Element.

- Titanium – Another obvious gimmick is the titanium card, which Apple describes as “beautiful.” However, there are some benefits to having a physical counterpart as the tech giant explained it has been designed for making payments at locations where Apple Pay is not accepted. This means that the credit card could be used in a number of countries in which there are many underserved by financial services, but where mobile penetration is high.

- Partnerships – While it is clear that the appetite is strong for an Apple credit card in the U.S., this foray into the credit space by Goldman is an interesting one, just three years after its personal finance platform Marcus was launched.

Read More.. Source Forbes