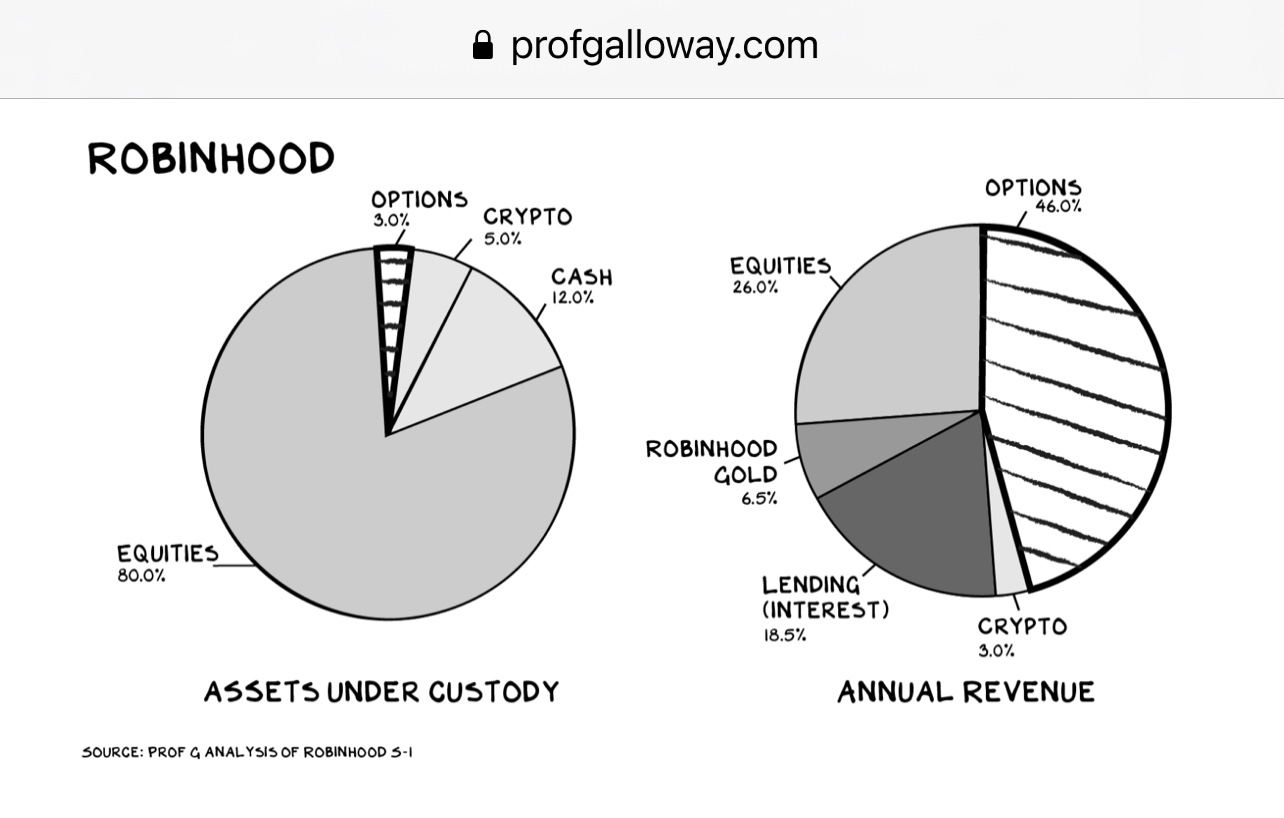

The company operates a mobile app that enables consumers to trade stocks, options, and crypto. These orders are the company’s inventory, which it sells to “market makers” — large financial institutions that pare (execute) the trades in the market. As with Google or Facebook, Robinhood’s users are not its customers, but its supply.

The transaction at the heart of the company’s model is “Payment for Order Flow” or PFOF. Because RH generates its revenue by selling orders to market makers, it doesn’t charge commissions to its consumer users. But this also creates a conflict of interest for the company, which is motivated to sell orders to the market maker that offers the highest payment for the trade rather than the best price. It’s like affiliate marketing, but for your financial future.

Read the full article on Prof Galloway