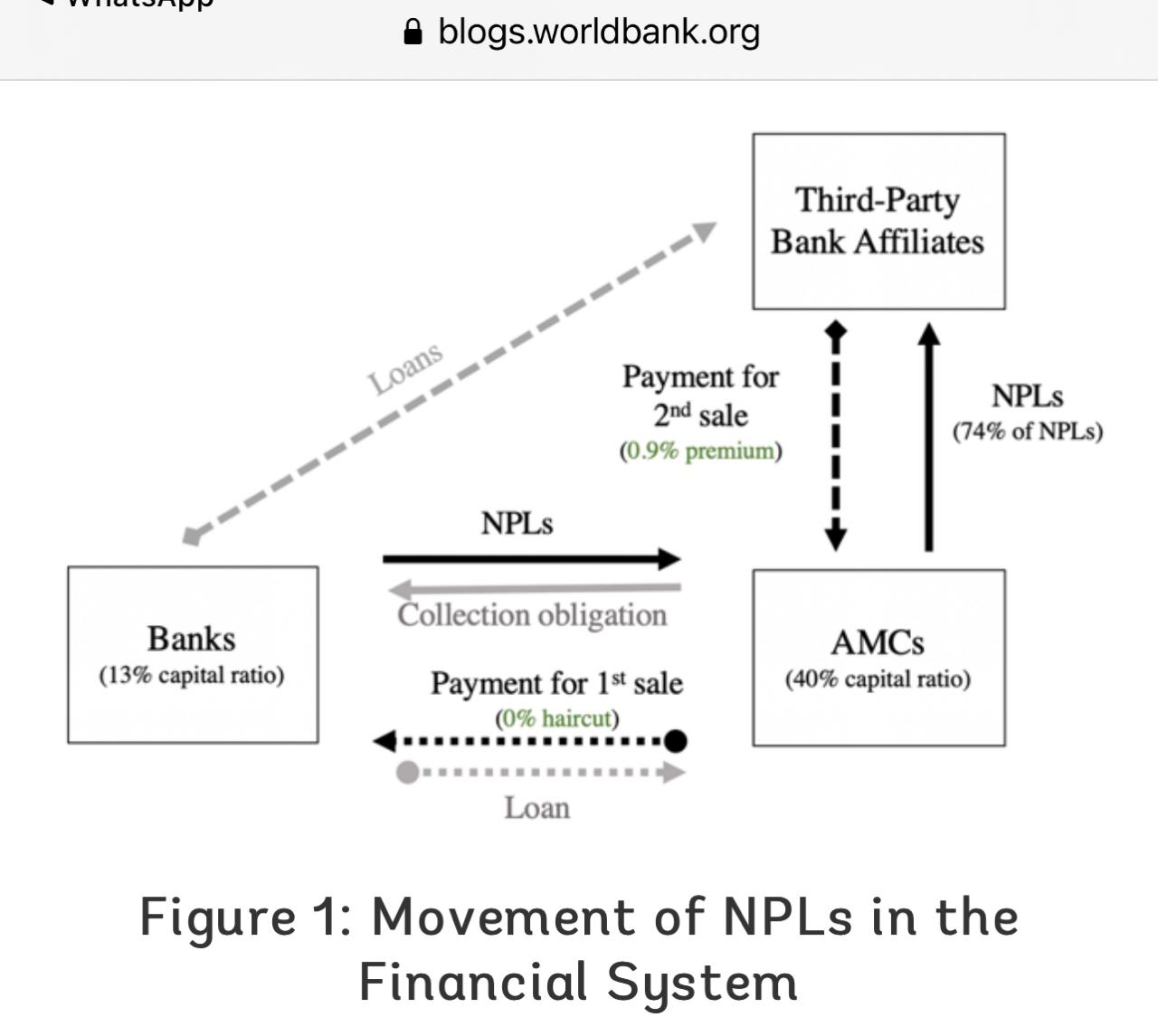

Three parties are involved in the concealment process: (1) banks, which want to remove NPLs from their balance sheets to comply with the quantity-based loan quality regulation; (2) AMCs, which are compensated for acting as pass-through entities; and (3) third-party bank affiliates, which are the ultimate owners of the NPLs and borrowers of the bank.

Because banks still remain exposed to those transacted NPLs in the process above, we call the transferred loans “hidden NPLs.” Although they are removed from bank balance sheets, the banks are still liable for their losses.

Read the full article at World Bank Blogs