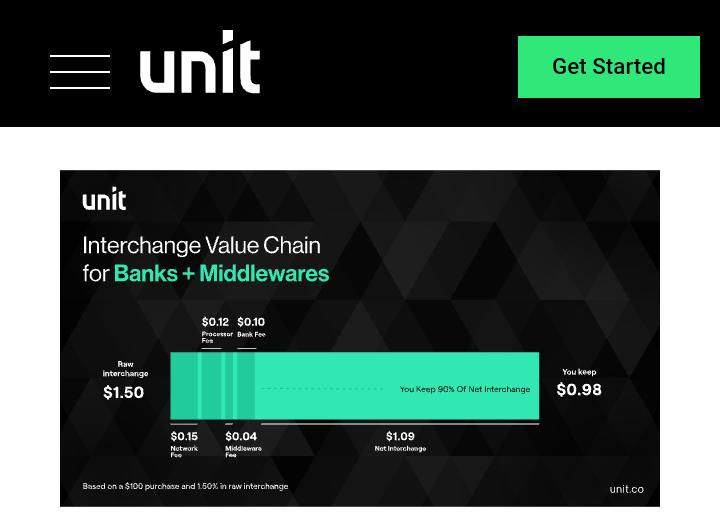

Online card purchases generate higher interchange fees than offline card purchases, in order to “compensate” the issuing institution for potential fraud risk. Based on the concept of Merchant Category Codes (or MCC), purchases at certain merchants may generate less interchange. For example, purchases at merchants that belong to a specific category (“Grocery Stores, Supermarkets”) could generate less interchange. Debit cards have lower interchange fees than credit cards due to lower credit risk for the issuing institution

Even if interchange is your main revenue stream, understanding it is hard: it’s often made of millions of transaction-level revenues and the variables change from one transaction to the next. Having a complete data set, and the tools to make sense of it, will help you understand how much of the interchange you’re seeing, and how much flows to your users. It will also help inform critical commercial decisions- for example, adding custom cash-back terms or launching a new VIP plan for your most loyal users.

Read the full article at Unit